Silicon Valley Real Estate Market Update: November 2023 Insights and Analysis

Kevin Swartz | November 21, 2023

market update

Kevin Swartz | November 21, 2023

market update

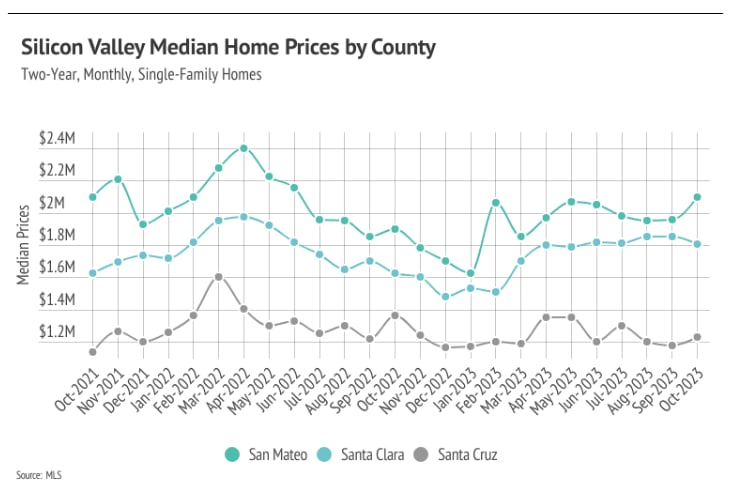

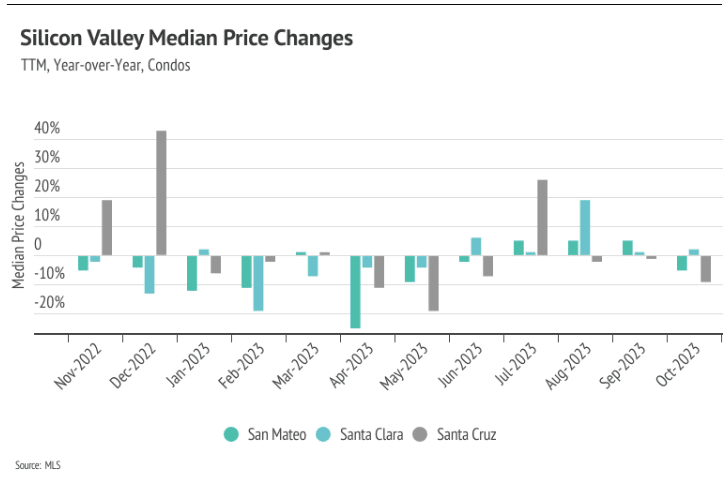

In Silicon Valley, home prices haven’t been largely affected by rising mortgage rates after the initial period of price correction from April 2022 to January 2023. In October, the median prices across most of the Silicon Valley counties were only slightly below their record highs. Increasing demand and low, but rising inventory helped drive the rapid home price appreciation that Silicon Valley experienced in the first half of the year. Single-family home and condo prices contracted over the past three months with the exception of San Mateo single-family home prices, which reached a high for the year in October. Year to date, prices have risen significantly across counties with the exception of Santa Cruz condo prices, which are down slightly. In the fourth quarter, we expect prices to remain fairly stable, but slight price contractions are normal this time of year.

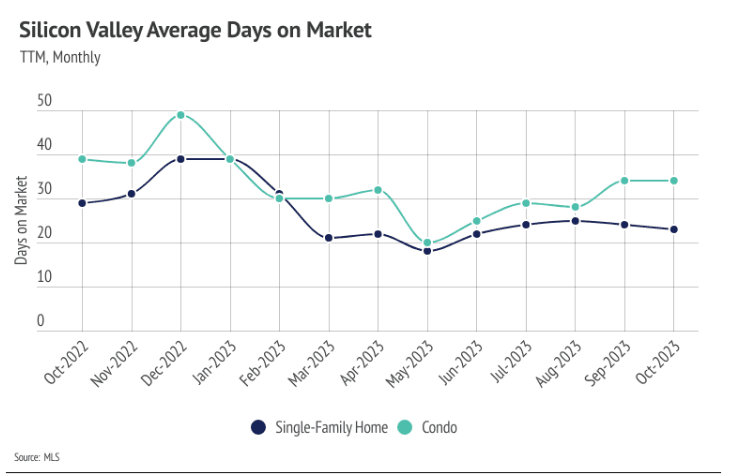

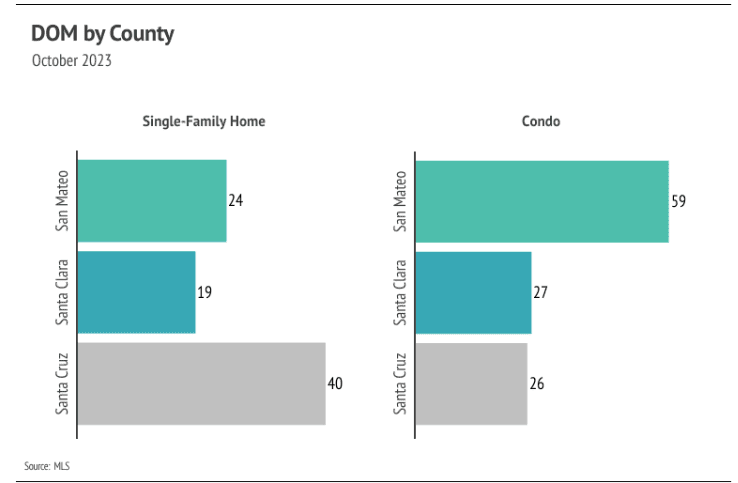

Typically, demand begins to decline in the fall and bottoms out in January, so the consistently low supply should be less of an issue. With mortgage rates at a 23-year high, buyers have more incentive to compete over the most desirable homes. Because of the cost of financing, homebuyers aren’t settling for less than the best home they can find.

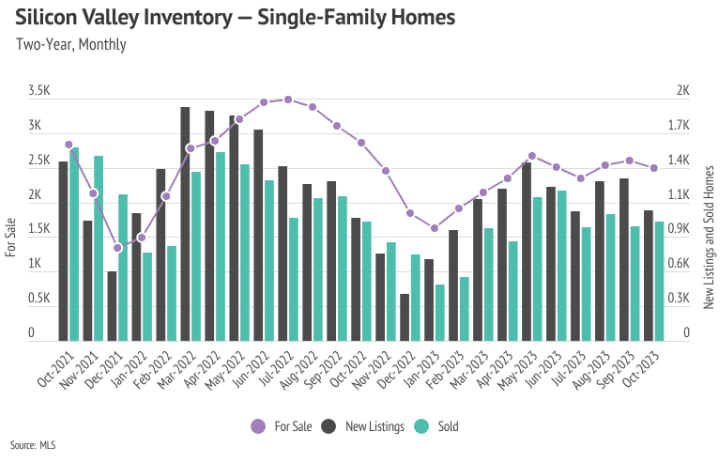

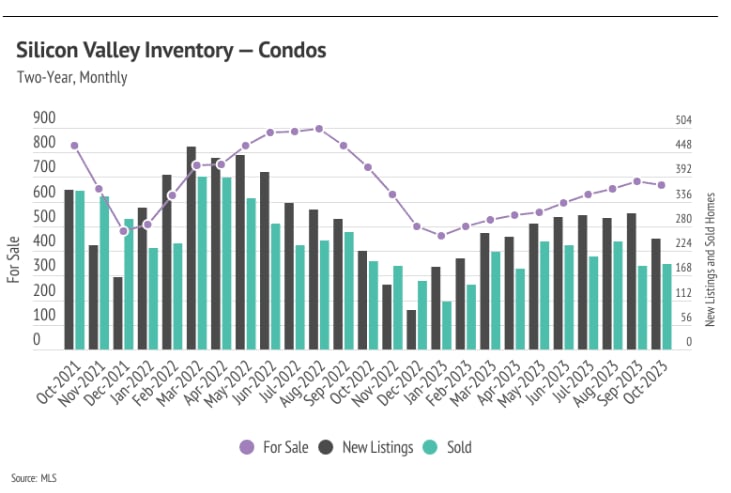

Single-family home inventory trended higher into the fall of 2023, peaking in September. Inventory declined in October as sales increased and new listings declined. Typically, inventory peaks in July or August and declines through December or January. Even though inventory increased this year, it’s still historically low, moving higher primarily due to softening demand (fewer sales) caused by higher interest rates, normal seasonality, and an atypical increase in new listings in September. The number of new listings coming to market is a significant predictor of sales. In September, new listings rose 2%, and in October, sales increased by 4%.

Even as demand slows, sellers are maintaining more negotiating power and receiving more than asking price on average. The average seller received 94% of list in January, which grew to 101% by May. From May to October, the average seller received 101% of list price in every month. Inventory will almost certainly remain historically low for the rest of the year, and will likely remain low in 2024, which will favor sellers.

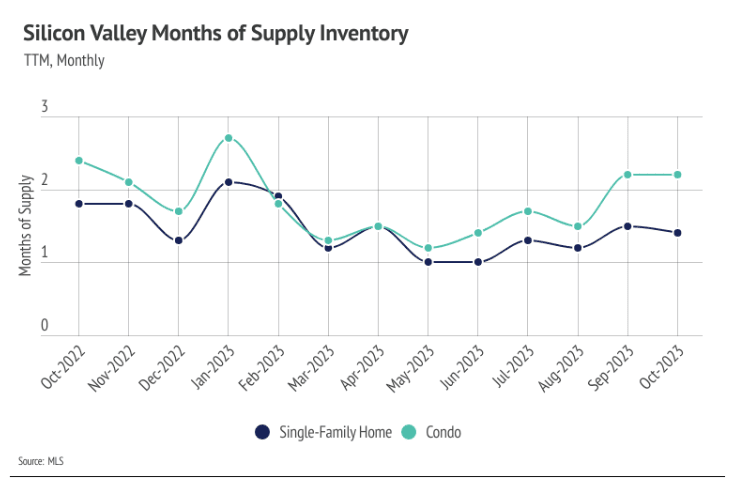

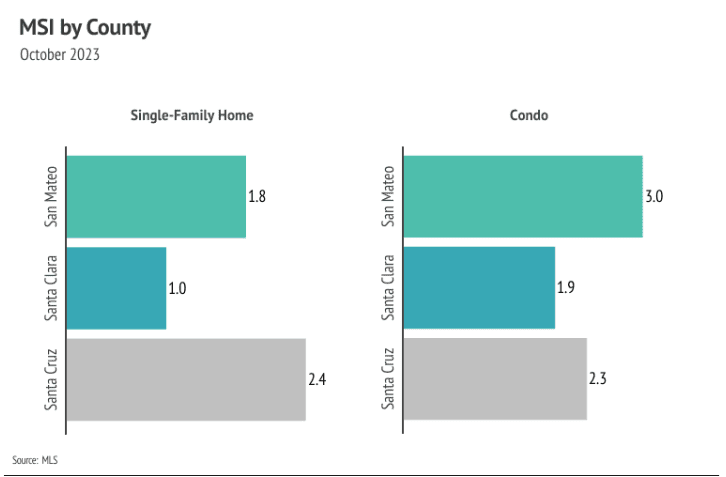

Months of Supply Inventory (MSI) quantifies the supply/demand relationship by measuring how many months it would take for all current homes listed on the market to sell at the current rate of sales. The long-term average MSI is around three months in California, which indicates a balanced market. An MSI lower than three indicates that there are more buyers than sellers on the market (meaning it’s a sellers’ market), while a higher MSI indicates there are more sellers than buyers (meaning it’s a buyers’ market). The Silicon Valley market tends to favor sellers, which is reflected in its low MSI. MSI fell sharply in the first quarter this year before gently trending higher starting in May. In October, MSI remained below three months of supply, indicating the market still favors sellers. The only exceptions are condos in San Mateo, which are closer to a balanced market.

Trends, prices, and insights shaping Silicon Valley housing this winter

Trends, prices, and insights shaping Silicon Valley housing this fall

You’ve got questions and we can’t wait to answer them.